Note: the following two articles are reprinted from Bloomberg.

Decade of Big S&P 500 Gains Is Over, Goldman Strategists Say

US stocks are unlikely to sustain their above-average performance of the past decade as investors turn to other assets including bonds for better returns, Goldman Sachs Group Inc. strategists said.

The S&P 500 Index is expected to post an annualized nominal total return of just 3% over the next 10 years, according to an analysis by strategists including David Kostin. That compares with 13% in the last decade, and a long-term average of 11%.

They also see a roughly 72% chance that the benchmark index will trail Treasury bonds, and a 33% likelihood they’ll lag inflation through 2034.

“Investors should be prepared for equity returns during the next decade that are toward the lower end of their typical performance distribution,” the team wrote in a note dated Oct. 18.

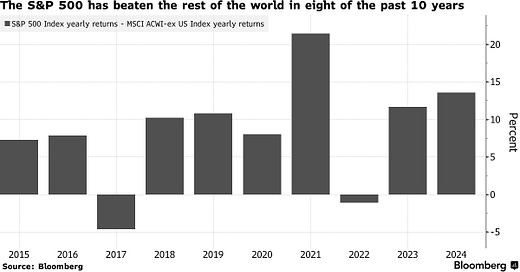

US equities have rallied following the global financial crisis, first driven by near-zero interest rates and later by bets on resilient economic growth. The S&P 500 is on track to outperform the rest of the world in eight of the last 10 years, according to data compiled by Bloomberg.

Source: https://www.bloomberg.com/news/articles/2024-10-21/s-p-500-s-decade-of-big-gains-is-over-goldman-strategists-say?cmpid=BBD102324_MKTDLY&utm_medium=email&utm_source=newsletter&utm_term=241023&utm_campaign=marketsdaily&leadSource=uverify%20wall&embedded-checkout=true

Xxx

Goldman creates a stir

Forecasting the market is hard, some would say impossible. But that doesn’t keep Wall Street's best and brightest from diving in to the fray, year after year. Rarely have their predictive energies been on greater display than this week, when Goldman Sachs warned that annual S&P 500 returns may narrow to a paltry 3% over the next decade, only for JPMorgan Asset Management to say the view is too dour.

Why is it so hard to see the future of stocks and bonds? The main reason is the role of big, calamitous events in shaping their destiny. Things come out of nowhere — a pandemic, wars, oil embargoes - and predictions premised on business as usual are often torn up.

This fact led Nicholas Colas, co-founder of DataTrek Research, to argue in a note yesterday that unless something of that scale happens again, getting as gloomy as Goldman Sachs did in its outlook is usually a mistake. Long-term returns of 3% or less have happened just a handful of times, coinciding with traumas such as the financial crisis, the 1970s oil shock and Great Depression.

“We have read nothing that outlines what crisis their researchers are envisioning,” they wrote. “Without one, it is very difficult to square their conclusion with almost a century of historical data.”

This year has been a lesson in the relative futility of forecasting. Back in January, Wall Street strategists on average were expecting the S&P 500 would rise by about 2%. It’s up 23%.

Of course, it's the nature of calamity that it comes without warning — to say there’s no crisis looming over markets now doesn’t mean there won’t be sometime soon. And while it’s true that most of history’s lean seasons in equities correspond to catastrophes, there is a notable exception: the early 2000s bursting of the dot-com bubble, a period when the biggest problem investors faced was valuations.

With the S&P 500’s price-earnings ratio approaching those levels, it may be an exception worth noting. —Denitsa Tsekova

Source: https://www.bloomberg.com/news/newsletters/2024-10-23/goldman-s-grim-view-whips-up-a-debate-on-stocks?cmpid=BBD102324_MKTDLY&utm_medium=email&utm_source=newsletter&utm_term=241023&utm_campaign=marketsdaily&embedded-checkout=true

I hope you have taken the time to read both reprints above, because we rarely see the Professionals being this honest and direct in public. Most prefer to forget that you must always pay the reaper and what goes up must come down. Few are prepared to make money during a crash or extended trading range. Goldman will, because they will trade like Professionals. They know all boats float in a rising tide and the excess returns most have had over the past decade were not from any skill in trading, but just being in the market. Now we will have the opportunity to see who really knows how to manage money and trade. If you don’t retire now at the top or lean how to Trade Like A Pro.

NOTE: New posts will be on the second and fourth Tuesday of the month.

If you want to learn about this and more I have two resources for you:

- Online Self-Paced Course: Trade Like A Pro (TLAP) course. Learn to trade like a Professional at your own pace. Read the testimonials here.

- Group Mentoring: Join the Mastermind Group and get the TLAP course for free.

Be well and trade like a pro,

Lloyd

P.S. if you found this of value please like and subscribe, thanks.

If you are already subscribed, please share with others.